How To Subtract Gst From Total Amount In Excel

You can type either value into the formula and Excel will give you the correct answer. HSTQSTPST variable rates Amount without tax Current HST GST and PST rates table of 2021 On March 23 2017 the Saskatchewan PST as.

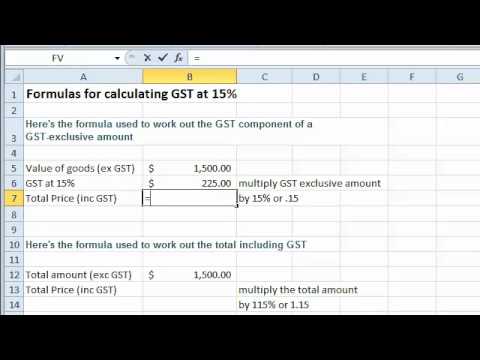

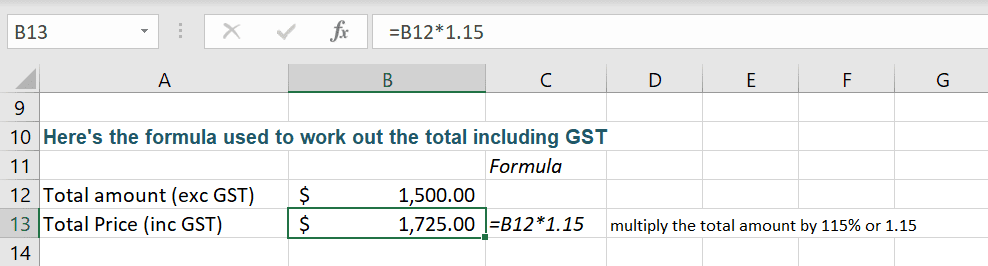

How To Calculate Gst At 15 Using Excel Formulas Excel At Work

In cell B7 the GST exclusive amount.

How to subtract gst from total amount in excel. Learn how to write formulas in Excel to calculate GST at 15. This also helps you do some practice in Excel------Please watch. The result is 700 which is 625 of 1200.

I created a spreadsheet that will subtract my postal charges from the total amount I created in a purchase request. I need a formula that calculates the -5 GST I can not just subtract Total - GST PRICE 1999 1999 1999 SUBTOTAL 5997 PST 8 480 GST 5 300 TOTAL 6777 TAKE OUT GST. The GST-exclusive price of the product is 9091.

Total sale amount selling price sales tax. GST returns and payments due for the taxable period ending the prior December. Calculate the GST component to be added to a GST exclusive.

The tax is not charged separately from the customer. 90 of the original amount. Selling price x sales tax rate and when calculating the total cost of a purchase the formula is.

To do this you simply multiply the value excluding GST by 15 or by 015. Then apply the Tax Amount Calculator formula in column C as shown in the picture below. The mailing charges are subtracted for each cell in column G so in cell G5 I typed 522 and then the results are shown in column H or in this case cell.

Note that the value in cell D6 is a decimal value in this case 625 formatted with the Percentage number format and zero decimal places. GST or Income tax formula in excel. To calculate the amount Excel simply multiplies the value in cell C6 1120 by the percentage value in cell D6 625.

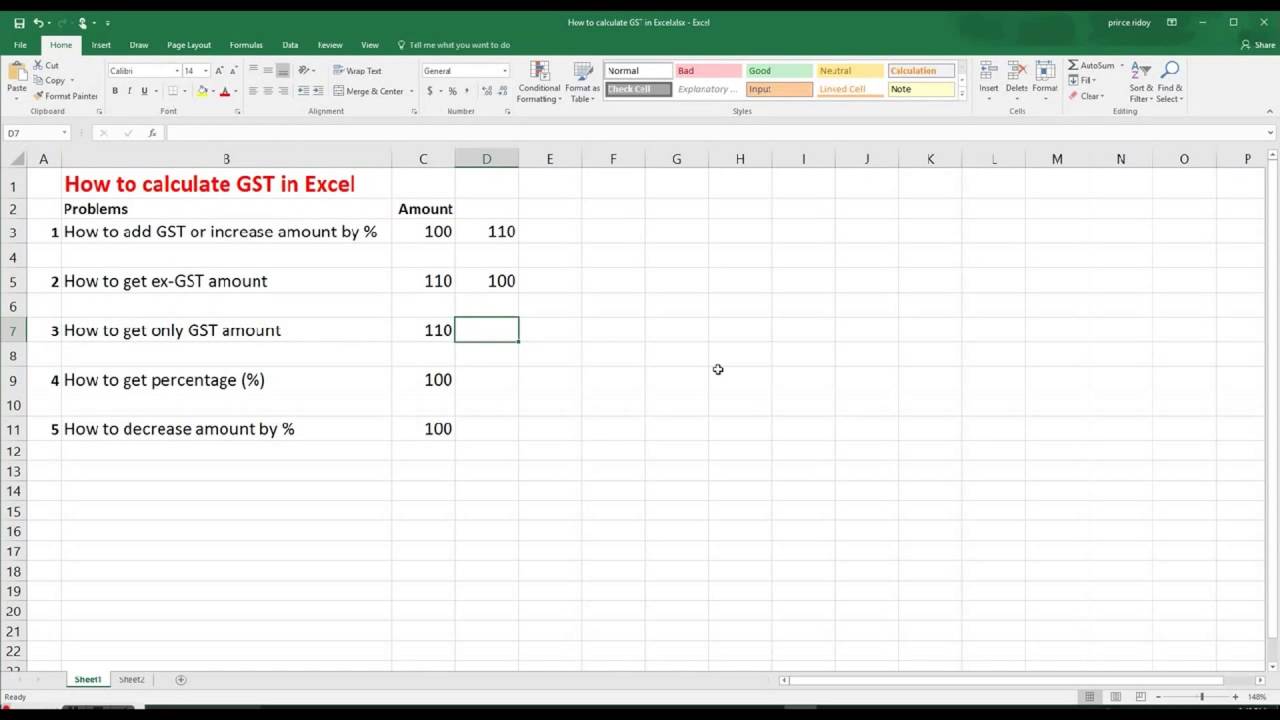

This Excel tutorial shows different techniques to calculate and find GST amounts. 909 multiplied by 10 GST rate of 10 9091. Your rent subsidy rate is 0.

To subtract the numbers in column B from the numbers in column A execute the following steps. To find the total including GST simply add the two values together. How much is GST in New Zealand.

To calculate a total price that includes GST just multiply the amount by 11. GST Due Dates. As mentioned above it is currently 15.

The GST amount on the product is 909. Calculating GST has never been easier on our handy NZ GST Calculator. For all examples we will use a VAT rate of 16.

In the previous example you were actually asking excel to subtract 01 from 83279 instead of reducing the number by 10. What is GST Exclusive amount. When you type 10 into Excel Excel sees it as the value 01.

Since Goods and Services Tax was introduced in 2000 thousands of Australians have to calculate the amount of GST to add to the price of goods or services or calculate how much GST is included in the price to claim tax credits for any GST included in the price of goods services. Formulas to calculate price including tax. If we were to simply subtract 10.

The formula for calculating the sales tax on a good or service is. GST inclusive amount refers to the total value of the product after including the GST amount in the original value of the product. Quickly find 15 GST amount for any price or work backwards to get the original GST-exclusive price if you only have the GST-inclusive one.

And now write the percentage of tax in column B. The GST is a broad-based tax of 10 on the supply of most goods services and anything else consumed in Australia. To calculate how much the price was before GST just divide by 11.

To calculate the GST on the product we will first calculate the amount of GST included then multiply that figure by 10 The GST rate. 100 divided by 11 909. In the tutorial I show you how to.

What is the formula to calculate GST in Excel. Excel does this with all percentage values. Orginal amount is 500 10 off would be sum500x09 450 ie.

First subtract the value in cell B1 from the value in cell A1. Paying two-monthly is the most popular method in New Zealand. 1 October 2010 - Present.

The Purchase request amount is 300000 which populates cell F5. Thats a lot of manual work for small-business owners to do every time they want o calculate GSTuse our. GST Exclusive amount refers to the value of the product by subtracting the GST amount from the GST Inclusive value of the product.

Now first of all write down the amount you want to calculate tax in column A. 50 is 05 75 is 075 and so on. This causes 625 to display as 63.

Take a look at the screenshot below. The maximum your revenue drop - 50 x 125 40 your revenue drop x 08. So the end amount should be 6477.

Amount with taxes Canada Province. In the example below B5 has been multiplied by 015 which is the same as 15. People who are exceptionally good in business arent so because of what they know but because of their insatiable need to know more.

Next select cell C1 click on the lower right corner of cell C1 and drag it down to cell C6. You can choose whether to submit and pay GST monthly two-monthly or six-monthly - it depends on your business size and personal situation - see the IRD website for more details. Example shown 300 is the GST amount.

To calculate how much GST is included in a price just divide by 11. The CERS amount you can apply for is a percentage of your eligible expenses for all your business locations 0. To do this you simply multiply the value excluding GST by 15 or by 015.

Calculate Tax VAT If you have a product priced at 75 excluding VAT the VAT amount can be calculated as follows. Then add these two Amounts in Column D You will be presented with the Tax Amount.

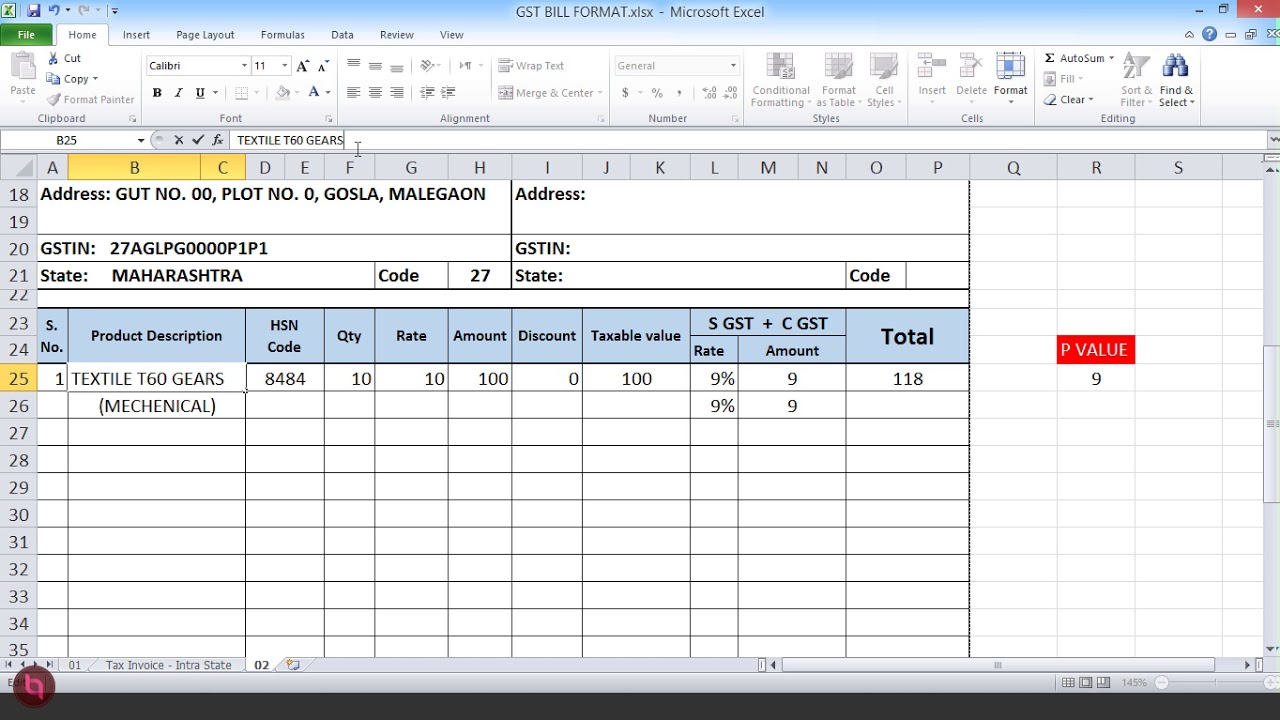

How To Calculate Gst In Excel By Using Different Techniques With Easy Step By Step Tutorial Youtube

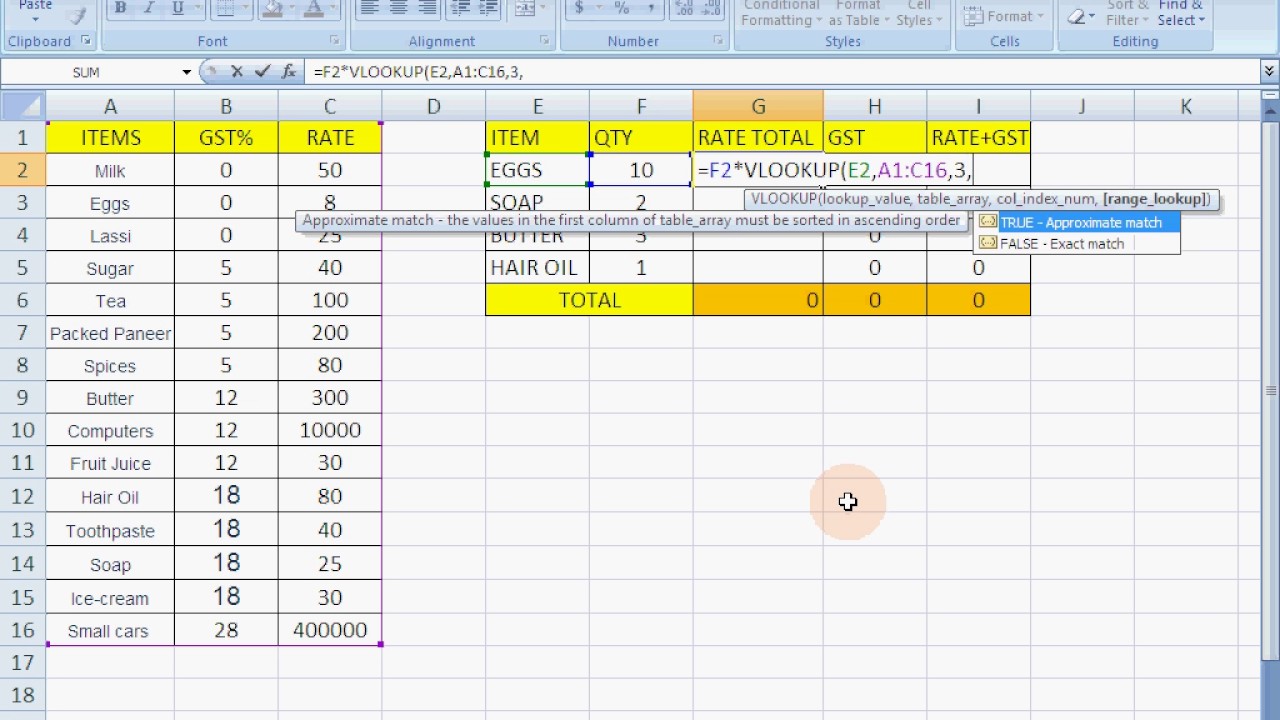

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

Top 5 Ways To Use Percentages In Excel Trainers Direct Computer Courses Sydney Corporate Training

How To Calculate Gst Or Income Tax In Excel

If The Total Amount Is Rs 2065 Including The Gst 18 Then What Is The Actual Price Quora

How To Calculate Gst At 15 Using Excel Formulas Excel At Work

Formulas To Include Or Exclude Tax Excel Exercise

How To Calculate Gst At 15 Using Excel Formulas Excel At Work

How To Calculate Gst In Excel Soccerlasopa

Gst Formula Excel In Hindi Youtube

Formulas To Include Or Exclude Tax Excel Exercise

Formulas To Include Or Exclude Tax Excel Exercise

How To Calculate Gst In Excel Wolasopa

Formulas To Include Or Exclude Tax Excel Exercise

Formulas To Include Or Exclude Tax Excel Exercise

How To Calculate Vat In Excel Vat Formula Calculating Tax In Excel

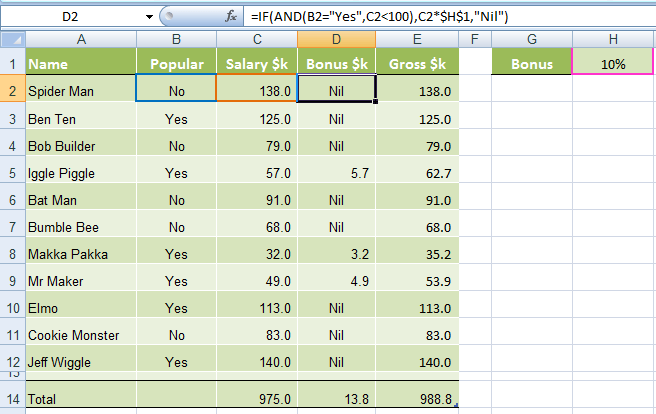

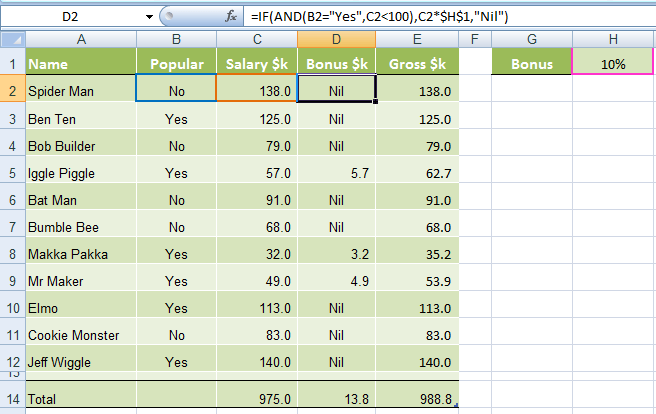

Excel If And Or Functions Explained My Online Training Hub

Best Excel Tutorial How To Calculate Gst